Category Archives: Tax Preparation Service

Accountant | Tax Preparer for Uber or Lyft Drivers

We came across this post on uberpeople.net and commented on it. The questions asked is below. Discussion Starter · #1 · Oct 3, 2018 Any clues on how to find the best recordkeeping, tax filing advice? Key word...

Read More ›

Here’s What’s New and What to Consider When Filing in 2022

The IRS encourages taxpayers to get informed about topics related to filing their federal tax returns in 2022. These topics include special steps related to charitable contributions, economic impact payments and advance child tax credit...

Read More ›

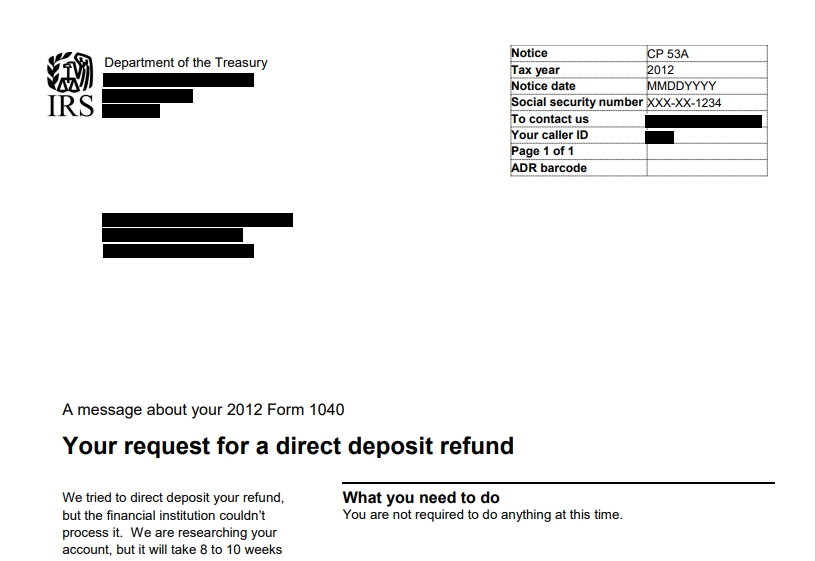

What is a CP53A IRS Letter?

Question: Why did I get a cp53a from the IRS if I didn't file taxes for 2020 it came in my child name also her father filed not me?” The IRS CP53A Letter means IRS tried to deposit your tax refund into your bank account but your bank cannot...

Read More ›