Category Archives: Tax

What is Schedule C (Form 1040) – Uber, Lyft and Taxi...

If you earned $600 or (someone pay you $600) or more, you were not an employee of a company or the person that paid you the $600, you are consider Self-Employed or an Independent Contractor for IRS tax filing. You will have to file Form Schedule...

Read More ›

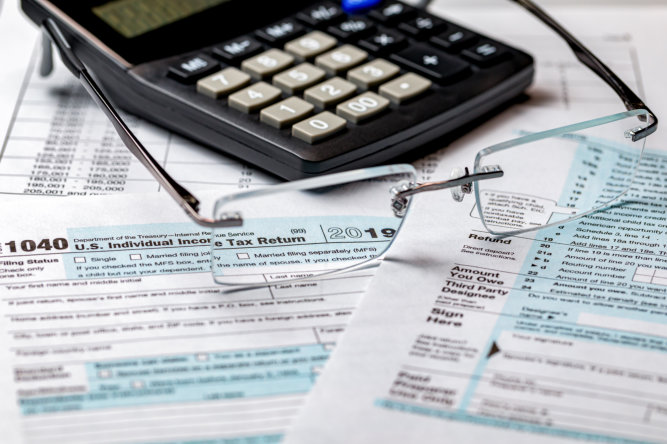

What is a CP53A IRS Letter?

Question: Why did I get a cp53a from the IRS if I didn't file taxes for 2020 it came in my child name also her father filed not me?” The IRS CP53A Letter means IRS tried to deposit your tax refund into your bank account but your bank cannot...

Read More ›

What is Republic Bank Trs RT Fed

According to Republic Bank, a Republic Bank Refund Transfer (RT) allows customers to pay for their tax preparation fees with their refund check from the IRS. A Refund Transfer Fee will be charged in addition to the tax preparation fees upon...

Read More ›

States Giving Out More Stimulus Money

We can help you get your stimulus money. Call us (213) 418-9600 or (866)542-9551 Below are states that are giving out stimulus money. California California has authorized payments of $600 to qualifying taxpayers in the state who make under...

Read More ›

I Did Not Get My (1st) First or (2nd) Second Stimulus...

If you have not received your first or Second Stimulus Payment, no problem. Call Us @ (866)542-9551 or email us at lapremiertax@gmail.com | We will file a CLAIM i.e. tax return for you. Get Your Stimulus Money - Call Us Today...

Read More ›

Get Your Stimulus Money

Third Round of Economic Impact Payments Status Available IRS is issuing the third payments in phases. Find when and how we sent your third Economic Impact Payment with the Get My Payment application. Get My Payment updates once a day, usually...

Read More ›